Singara Chennai Card Full KYC at Designated SBI Branches: A Complete Guide

The Singara Chennai Card is revolutionizing travel in Chennai by offering a cashless, contactless, and convenient way to commute. Launched by Chennai Metro Rail Limited (CMRL) in collaboration with State Bank of India (SBI), this smart card can be used for metro travel and is designed to become a multi-modal urban mobility card in the future. However, to unlock its full potential and benefits, users must complete the Full KYC (Know Your Customer) process.

In this blog, You’ll explore everything you need to know about completing Full KYC for your Singara Chennai Card at designated SBI branches in Chennai. You’ll cover the benefits of Full KYC, how to find eligible SBI branches, required documents, and step-by-step procedures.

What is the Singara Chennai Card?

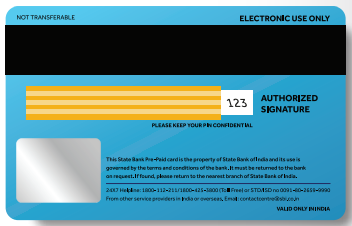

The Singara Chennai Card is a National Common Mobility Card (NCMC) that works not just for metro rides but will soon integrate with buses, suburban trains, parking systems, and more. It is a RuPay-based prepaid card developed in partnership with SBI, enabling digital payments across a wide range of services.

Why Full KYC is Important

Completing Full KYC for your Singara Chennai Card enhances its functionality and ensures compliance with banking norms. Here are key benefits:

- Higher Transaction Limits: With Full KYC, you can store and spend higher amounts on the card.

- Wider Usage: Use the card beyond metro rides—on buses, retail outlets, and online platforms.

- Reload Capability: Full KYC allows unlimited top-ups compared to limited value for non-KYC cards.

- Security and Support: In case of loss or fraud, Full KYC ensures better customer support and recovery.

Where to Complete Full KYC: Designated SBI Branches in Chennai

To complete Full KYC, you must visit one of the designated SBI branches in Chennai. These branches have been authorized to process KYC applications for the Singara Chennai Card. While the list may be updated periodically, some of the commonly designated branches include:

- SBI Annasalai Branch

- SBI Mount Road Branch

- SBI T. Nagar Branch

- SBI Nungambakkam Branch

- SBI Egmore Branch

- SBI Adyar Branch

- SBI Tambaram Branch

- SBI Guindy Branch

- SBI Ashok Nagar Branch

- SBI Central Branch (Chennai)

Please note: It is recommended to call the branch ahead or check with CMRL/SBI’s official website to confirm current designated branches for Singara Chennai Card KYC.

Documents Required for Full KYC

When visiting the branch, carry the following documents:

1. Original and copy of government-issued ID proof:

- Aadhaar Card

- PAN Card

- Voter ID

- Passport

- Driving License

2. Passport-size photograph (if required)

3. Mobile number registered with the card

4. Existing Singara Chennai Card

Ensure that all details match the records used while registering your card initially.

*The customer has to fill the Application form for conversion of the Minimum Details Card to Full KYC card. The form will be provided by the designated branches.

Step-by-Step Procedure to Complete Full KYC

1. Locate the Nearest Designated SBI Branch:

Use SBI’s branch locator or CMRL’s announcements to find the nearest Full KYC-enabled branch.

2. Visit During Working Hours:

It is advisable to visit on a weekday between 10 AM and 3 PM to avoid peak hours.

3. Approach the Help Desk or Customer Service Executive:

Mention that you wish to complete Full KYC for your Singara Chennai Card.

4. Submit the KYC Form:

Fill out the KYC form provided by the branch. It will include:

- Full name

- Address

- Date of birth

- Card details

- Signature

6. Submit the Required Documents:

Hand over copies of your ID proof and any supporting documents along with the form.

7. Verification Process:

The bank official will verify your documents and match them with your card registration.

8. KYC Completion Confirmation:

Once verified, your card will be marked as Full KYC compliant. The update usually reflects in a few hours or up to 1–2 working days.

Post-KYC Benefits and Usage

After completing Full KYC:

- Your transaction limit increases: Up to Rs. 2,00,000 depending on the RBI guidelines.

- You can use your card across NCMC-compatible platforms: Including buses, tolls, shops, and online transactions.

- Eligible for card replacement and balance recovery: If your card is lost or damaged.

- No need to re-verify for each recharge: Seamless top-ups using any channel.

Tips to Ensure Smooth KYC Process

- Double-check your documents and ensure they are valid and not expired.

- Carry both originals and photocopies of ID documents.

- Confirm the designated branch before visiting.

- Ensure the mobile number provided matches your card registration.

Frequently Asked Questions (FAQs)

Q1. Is Full KYC mandatory for using the Singara Chennai Card?

A: No, but it is required for higher usage limits and multi-modal benefits.

Q2. Can I do Full KYC online?

A: Currently, KYC for the Singara Chennai Card must be completed in person at designated SBI branches.

Q3. Is there a fee for Full KYC?

A: No, completing Full KYC is free of cost.

Q4. How long does Full KYC processing take?

A: Most updates are completed within 1–2 working days.

Q5. Can I do KYC at any SBI branch?

A: No, only designated SBI branches in Chennai are equipped for Singara Chennai Card KYC.

Contact and Support

- CMRL Helpline: 044 – 2379 2000

- SBI Customer Care: 1800 425 3800

- CMRL Website: https://chennaimetrorail.org

- SBI Branch Locator: https://sbi.co.in

Conclusion

Completing Full KYC for your Singara Chennai Card is a simple but important step toward unlocking all the advanced features of the card. Whether you are a regular metro user or plan to use the card for broader digital transactions, Full KYC ensures security, higher limits, and flexibility. Visit your nearest designated SBI branch in Chennai, carry the required documents, and complete your KYC to enjoy a truly seamless and smart travel experience.

Stay informed by checking updates from CMRL and SBI as more services and branches may be added to support the Singara Chennai Card ecosystem.